Against The Wind: Looking Back On My Student Debts

The surprising final installment of my long-running series on my student debt.

I started writing about my student debt in November 2021. After staying mostly silent about my debt over the past twenty-five years—due in large part to shame and embarrassment—I was inspired by this excellent conversation between two leading sociologists studying higher education and student debt: Tressie McMillan Cottom and Louise Seamster. They explain how debt is a social issue, not a personal failure. Everyone in America is affected by the $1,700,000,000 in outstanding student debt. Student debt is, like so much of our lives, socially determined. Talking more about how student debt affects our lives will lead to a better understanding of the need for wholesale reform of how the United States finances education.

By now, it should be obvious: the bargain that education policymakers struck in the 1960s, when the student debt industrial complex was created, never worked. The idea back then was to give students tons of financial aid (scholarships, grants, fellowships, and a little bit of debt if absolutely necessary). These generous aid packages would offset higher tuition, allowing the government to pull back subsidies for colleges and universities. Well, the “generous aid packages” never really showed up. Instead, over the past six decades, students took on more and more debt as the cost of tuition kept rising. The system, clearly, has been broken for a very long time.

Even though I am one of the lucky ones who escaped this system doing very well for myself, I decided that I should tell my story. Yes, I’ve fortunately had enough income to cover my monthly student loan bill: even when I had to pay nearly $500 per month over much of the 2010s. This is because I “graduated well,” as Seamster and McMillan Cottom describe it. I had the good fortune to turn my high-priced education into a great job in the field I went to school for. In many ways, my student debt story can be seen as a “best case scenario.”

And yet, my student debts caused a lot of harm in my life. As I’ve described in parts one through five of this series, I learned very quickly that the student debt industrial complex would do everything it could to extract profits out of me. Albion College didn’t step in to protect me, and neither did the State of Michigan. Twenty-five years working my way through this system cost me endless anxiety, countless hours of work, and yes, tens of thousands of dollars. The prospect of forgiveness kept me going over the past several years, but as recently as this spring, I had all but given up.

Forgiven?

After sending in yet another application under the Public Service Loan Forgiveness system, and getting yet another rejection, I decided I’d had enough. I was exhausted. I figured that I’d spent so many hours applying for forgiveness, that even if it was granted and all of my remaining debts were wiped away, I’d still barely have “earned” more than $7.25 per hour (or, the minimum wage in Pennsylvania) in forgiven debt. I had less than $5,000 to go. I started to think I should just keep making monthly payments when the COVID forbearance finally ends. I was defeated.

As a final, last-ditch move, I opened up the formal complaint form at the federal Department of Education. I wrote a brief, but detailed, description of how my loan servicing company, FedLoan, had mishandled my case by dragging out the forgiveness application process for well over six months. I sent the complaint out, and expected to hear nothing back.

And for months, I heard exactly that: nothing. But then, in late July, I unexpectedly received an envelope in the mail from Fedloan. Suddenly, without explanation, they had reversed their previous denial of my application. Congratulations, the letter said.

Twenty-five years after I first applied for a loan to go to college, my remaining student debts had been forgiven.

The Numbers

In total, from the time I mailed out my first repayment check in 1997 until the COVID forbearance started in early 2020, I repaid more than $40,000 in student debt. That includes $37,143 in loans that financed my tuition and fees at Albion College and at the University of California, Santa Barbara. After accounting for an additional $4,000 in interest that I paid to the banks, you arrive at that total amount that had to repay to the student loan industrial complex, right around $41,000. (For the record: I saved an average of $5.50 per year in interest payments, by turning on the monthly “auto-pay” feature, which granted me a small reprieve on my interest rate. That was a total savings of $114.87 over two decades. The system works!)

And here's the great news: My July 2022 loan forgiveness saved me thousands of dollars. Today, thanks to the Bush-era, totally broken Public Service Loan Forgiveness system, I now owe $0.00 in student debt. Thanks, George W. Bush?1

What have we learned by going through all of these numbers, and looking back at my personal experience with student debt? Again, mine is close to a "best case scenario" for the student debt system. And, let me tell you, dealing with student debt still has been soul crushing for me. It was difficult for me to repay, thanks to the unwieldy and always-shifting mechanics of actually keeping up with loan statements and online repayment systems. It also cost me a lot of time and money to deal with various errors and omissions in my loan accounts over the decades.

Still, in my case, student debt was 'worth it" because I got a great education and I was lucky to land a great job in the field that I was educated for. Even then: I wish I had never had to deal with student debt.

What I Couldn’t Do

When I landed a great job a few years after I graduated with my Ph.D., I couldn’t really save any of my income to put toward my retirement. I looked at my nearly $500 monthly loan payment as my “retirement” plan. I had to pour money backwards in time, you see, instead of building wealth into the future.

This also meant I felt that I couldn’t afford to buy a house until I’d turned 41 years old in 2020. The trouble I’d had with debt made me extremely risk averse, and I looked at a mortgage as a bad idea while I was making these big monthly payments toward my student debt. Even before housing costs went haywire in the late 2010s, I felt like buying a house was out of reach for me.

I have great mentors, great parents, and a tremendously supportive spouse. But after three years of unstable employment upon graduating with my Ph.D., after surviving the Great Recession, after hearing nothing but “budget crisis” at every turn, and seeing nothing but financial austerity for my entire career… can you blame me for being risk-averse with my finances?

In 2019, I finally finished repaying all of my debt from my undergraduate education, after more than twenty-two years of repayments. Closing that segment of my debts brought my monthly payment down to under $100 per month. I started to feel like maybe I could start putting away some of my income for retirement.

Then, the pandemic started.

It’s Even Harder For Kids Today

Again, I’m one of the lucky ones. I have never had to choose between paying my student debt bill and paying my rent. What’s more, getting a college education today is even more difficult for young people in most of America.

You know what isn’t hard, though? Getting richer if you’re already wealthy. Billionaires have accumulated more than a trillion more dollars since 2020. Paycheck Protection Program (PPP) loans went mainly to wealthy people, and unlike the Public Service Loan Forgiveness system for student loans (which is excruciatingly difficult), the process for getting a PPP loan forgiven is simple and easy!

And just as I wrote this, the word came out that President Biden would announce (as soon as today, August 24, 2022) a new student debt forgiveness program that would enable many debtors to escape from up to $10,000 in debt. (Update: here are the details announced today.) Great. Unfortunately, the reports say that the Biden forgiveness will come with means testing—the debtor will apparently have to prove that they made less than $125,000 in income this year. So, there will be hoops to jump through. Paperwork to fill out. Bureaucracies to contend with. As someone who has contended with student debt paperwork for the past 25 years, let me tell you, this will be a huge problem. And you don’t have to take it from me. Take it from the President of the NAACP, who predicts that this limited forgivness would systematically and disproportionately affect Black debtors and other marginalized groups who generally have less time and cultural capital to contend with means testing bureaucracies.

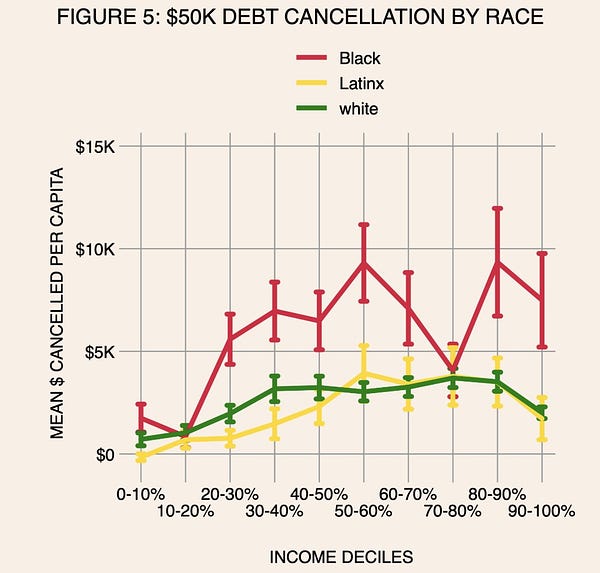

Or, take it from a scholar who co-authored research showing that a blanket student debt cancellation (for all student debtors) would benefit the “bottom 60% of earners” the most, and that “low-wealth Black individuals” would have the most to gain. In other words, student debt cancellation—if not means tested and limited—could be progressive in the truest sense of that word.

Saying Goodbye To My Debts

Well, President Biden, $10,000 of student debt forgiveness just isn’t good enough. I’m fortunate that my twenty-five-year-long personal struggle with student debt ended, just a few weeks ago. But tens of millions of my fellow debtors are not so lucky.

As I say goodbye to my debts, I want move forward to do what I can to open up access to learning and scholarship. Institutions need to do more with what they have to advocate for that mission. Governments need to reinvest in education at all levels. Private schools need to spend more of their endowments to support their educational missions.

And finally, let me say very simply what many others have already said many times, and more eloquently and powerfully than I can:

Student debt should be forgiven. All of it.

As best as I can tell, my April 2022 formal complaint to the Department of Education caused Fedloan to go back into my file. (Previously, Fedloan told me they could not verify my eligibilty for forgiveness, and they planned to send my file over to yet another servicing company by the end of 2022.) It seems that in July 2022, Fedloan reversed their decision and finally saw that I did indeed qualify under Public Service Loan Forgiveness. So, I think I actually need to thank Education Secretary Miguel Cardona. Thanks, Secretary Cardona!